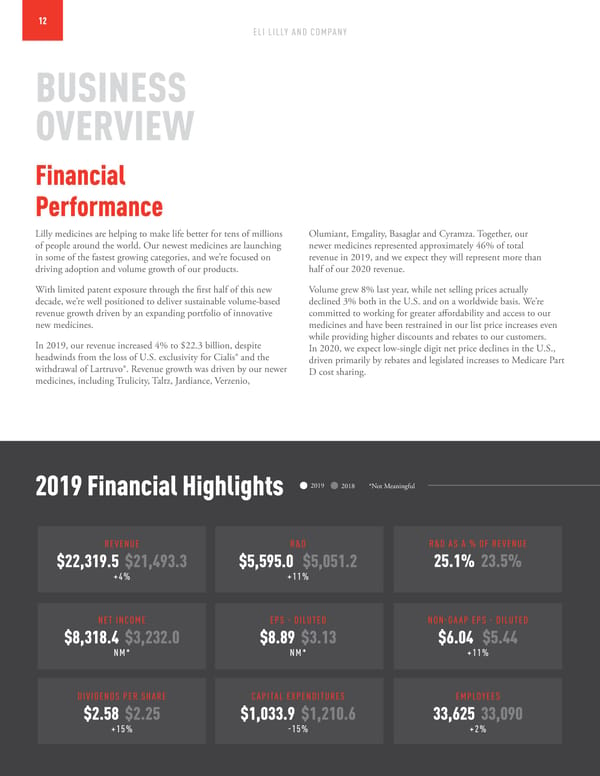

12 ELI LILLY AND COMPANY BUSINESS OVERVIEW Financial Performance Lilly medicines are helping to make life better for tens of millions Olumiant, Emgality, Basaglar and Cyramza. Together, our of people around the world. Our newest medicines are launching newer medicines represented approximately 46% of total in some of the fastest growing categories, and we’re focused on revenue in 2019, and we expect they will represent more than driving adoption and volume growth of our products. half of our 2020 revenue. With limited patent exposure through the first half of this new Volume grew 8% last year, while net selling prices actually decade, we’re well positioned to deliver sustainable volume-based declined 3% both in the U.S. and on a worldwide basis. We’re revenue growth driven by an expanding portfolio of innovative committed to working for greater affordability and access to our new medicines. medicines and have been restrained in our list price increases even In 2019, our revenue increased 4% to $22.3 billion, despite while providing higher discounts and rebates to our customers. headwinds from the loss of U.S. exclusivity for Cialis® and the In 2020, we expect low-single digit net price declines in the U.S., withdrawal of Lartruvo®. Revenue growth was driven by our newer driven primarily by rebates and legislated increases to Medicare Part medicines, including Trulicity, Taltz, Jardiance, Verzenio, D cost sharing. 2019 Financial Highlights 2019 2018 *Not Meaningful REVENUE R&D R&D AS A % OF REVENUE $22,319.5 $21,493.3 $5,595.0 $5,051.2 25.1% 23.5% +4% +11% NET INCOME EPS - DILUTED NON-GAAP EPS - DILUTED $8,318.4 $3,232.0 $8.89 $3.13 $6.04 $5.44 NM* NM* +11% DIVIDENDS PER SHARE CAPITAL EXPENDITURES EMPLOYEES $2.58 $2.25 $1,033.9 $1,210.6 33,625 33,090 +15% -15% +2%

Integrated Summary Report Page 12 Page 14

Integrated Summary Report Page 12 Page 14