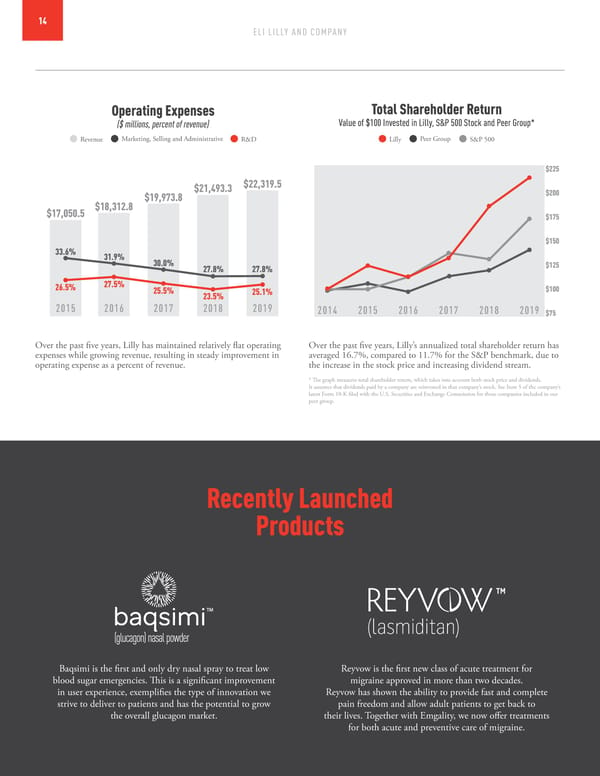

14 ELI LILLY AND COMPANY Operating Expenses Total Shareholder Return ($ millions, percent of revenue) Value of $100 Invested in Lilly, S&P 500 Stock and Peer Group* Revenue Marketing, Selling and Administrative R&D Lilly Peer Group S&P 500 $225 $21,493.3 $22,319.5 $19,973.8 $200 $17,050.5 $18,312.8 $175 $150 33.6% 31.9% 30.0% 27.8% 27.8% $125 26.5% 27.5% 25.5% 25.1% $100 23.5% 2015 2016 2017 2018 2019 2014 2015 2016 2017 2018 2019 $75 Over the past five years, Lilly has maintained relatively flat operating Over the past five years, Lilly’s annualized total shareholder return has expenses while growing revenue, resulting in steady improvement in averaged 16.7%, compared to 11.7% for the S&P benchmark, due to operating expense as a percent of revenue. the increase in the stock price and increasing dividend stream. * The graph measures total shareholder return, which takes into account both stock price and dividends. It assumes that dividends paid by a company are reinvested in that company’s stock. See Item 5 of the company’s latest Form 10-K filed with the U.S. Securities and Exchange Commission for those companies included in our peer group. Recently Launched Products Baqsimi is the first and only dry nasal spray to treat low Reyvow is the first new class of acute treatment for blood sugar emergencies. This is a significant improvement migraine approved in more than two decades. in user experience, exemplifies the type of innovation we Reyvow has shown the ability to provide fast and complete strive to deliver to patients and has the potential to grow pain freedom and allow adult patients to get back to the overall glucagon market. their lives. Together with Emgality, we now offer treatments for both acute and preventive care of migraine.

Integrated Summary Report Page 14 Page 16

Integrated Summary Report Page 14 Page 16